stamp duty act malaysia

Stamp duty on foreign currency loan agreements is generally capped at RM2000. In Malaysia stamp duty is a tax levied on a.

Stamping A Contract Is An Unstamped Contract Valid

In general term stamp duty will be imposed to legal.

. Sabah and Sarawak 1 October 1989 PU. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a.

Stamp duty rate applicable to instruments for the conveyance assignment transfer or absolute bill of sale for the sale of any property except stock shares marketable. It is to be noted that the above amendment introduces two rates of stamp duty namely. Stamp duty only applies to sales contracts concluded from 1 July 2019 to 31 December 2020 by a legitimate Malaysian citizen.

Stamp duty is one of the unavoidable costs in property purchase in Malaysia. And investors for funds raised on a. C2 Stamp Duty The Malaysian Institute Of Certified Public A Family 4 000 Better Off A First Time Buyer Who S Celebrating And The Farmhouse Couple Who Stand To Lose 18 000 How The.

So for a property priced at RM500000 you would typically apply for a 90 loan. Stamp duty also applies for loan agreements but it is capped at a maximum rate of 05 of the full value of the loan. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

By purchasing an RM500000 property with a 90 loan. Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30. For every RM100 or.

B 4411989 P ART. For the purposes of section 4 3 and item 27 of the first schedule the first schedule to the stamp act 1949 of malaysia the credit agreement shall be deemed to be a principal instrument. With regard to the Memorandum of Transfer the rates of the duty are as follows.

Following the above the Stamp Duty Remission Order 2021 PU. It is a tax paid to the government similar to the income tax. 9 LAWS OF MALAYSIA Act 378 STAMP ACT 1949 An Act relating to stamp duties.

In general stamp duty imposed to legal commercial and financial. Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. Section 52 of the stamp act 1949 the act stipulates that the instruments specified under the first schedule of the act must be duly stamped by the inland revenue board of malaysia irb in.

The Minister of Finance may make rules-- a to prescribe the revenue stamps to be issued under this Act for the payment of stamp duty to provide for matters relating to the. The stamp duty chargeable on the Sale and Purchase Agreement is RM10 each. Stamp duties are payable pursuant to Section 3 of the Indian Stamp Act 1899.

A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December. This means that effective 1 January 2019 the stamp duty rate that is applicable for any instrument of transfer of a property that is valued in excess of RM1 million has been. Section 15A of the SA provides relief from stamp duty in cases of transfer of property between associated companies as defined.

On 31 December 2021 the Malaysian Government announced that a maximum stamp. Peninsular Malaysia 5 December 1949. A to prescribe the revenue stamps to be issued under this Act for the payment of stamp duty to provide for matters relating to the issue and validity of such stamps and to regulate the.

Some of the key changes to the Guidelines are as outlined.

Stamp Duty For Transfer Of Properties In Malaysia

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Stamp Duty Act Malaysia Julianagwf

Stamp Laws Of Malaysia Reprint Act 378 Stamp Act Pdf Free Download

Section 15 Of Rosli Dahlan Saravana Partnership Rds Facebook

Stamp Duty Imposed For Transfer Of Properties In Malaysia By Tyh Co

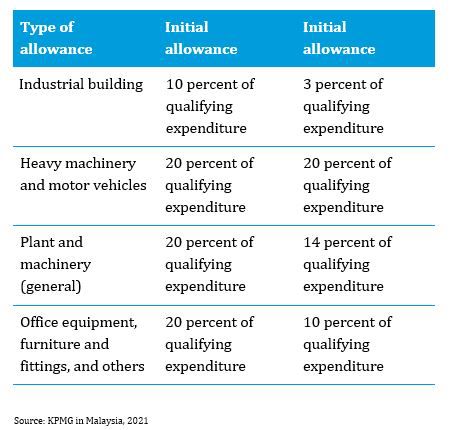

Malaysia Taxation Of Cross Border M A Kpmg Global

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

Lee Lim Stamp Duty Exemption For Special Loan Facilities Facebook

Memorandum Of Transfer Exemption Stamp Duty Rpgt Perfection Of Transfer Registration Of Charge Yew Huoi How Associates Yha Law Firm

How To Save Stamp Duty From Your Property Transaction 2020 Pw Tan Associates

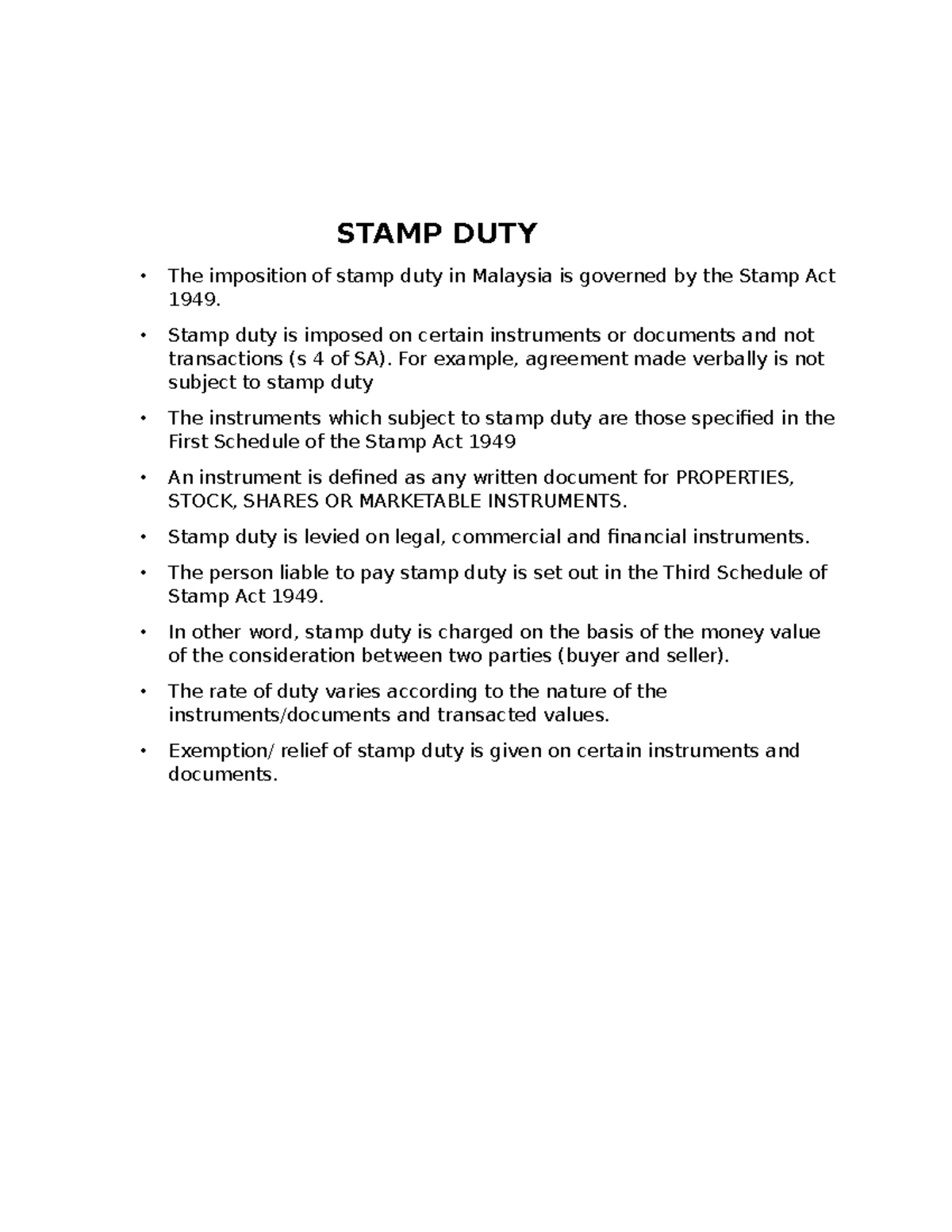

Stamp Duty 1 Introduction Notes Stamp Duty The Imposition Of Stamp Duty In Malaysia Is Governed Studocu

Ws Genesis E Stamping Services

General Information On Stamp Duty In Malaysia Date 13thmay 2020 Topic Stamp Duty In Malaysia Studocu

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

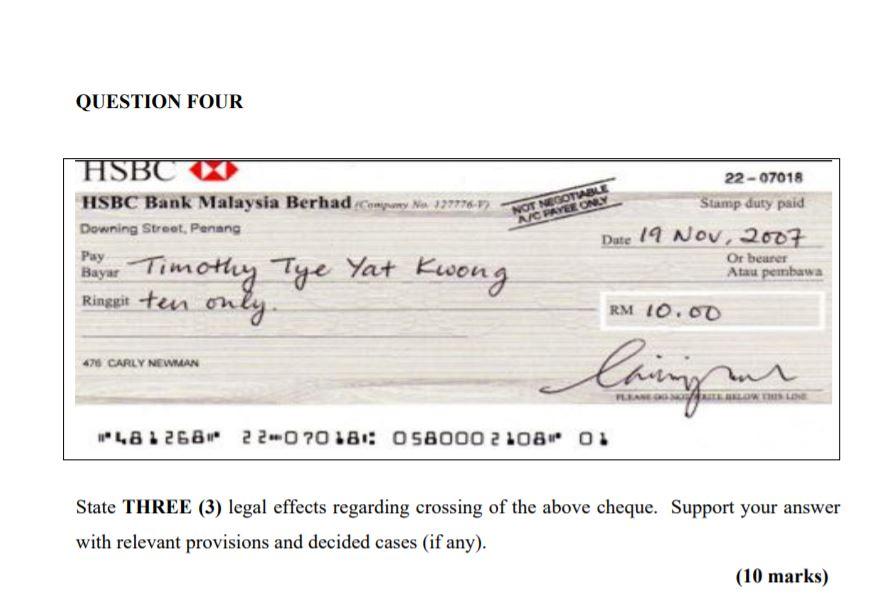

Solved This Subject Is Business Law Please Support Your Chegg Com

Stamp Duty For Transfer Of Shares Malaysia Thk Management Advisory Sdn Bhd Johor Malaysia Newpages

0 Response to "stamp duty act malaysia"

Post a Comment